USER GUIDE – Ichimoku EA

Trading Strategies

Five popular trading strategies based on the various Ichimoku elements. Each of the strategies has it unique entry and exit point without any interference to other strategies.

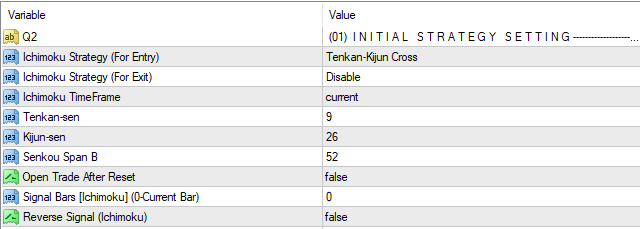

Initial Strategy Setting

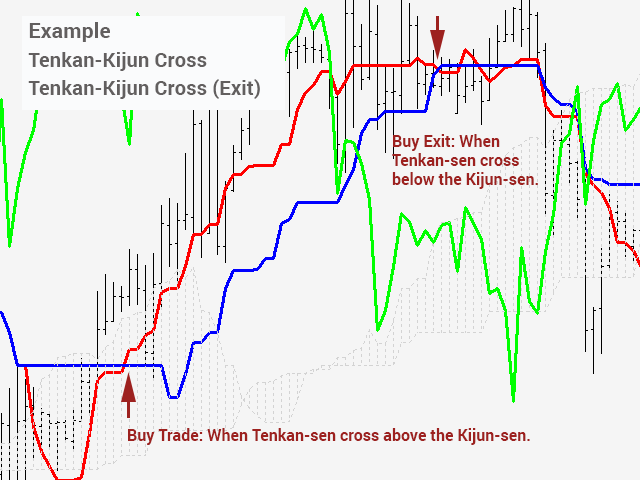

Tenkan-Kijun Cross :

- Buy Trade: When Tenkan-sen cross above the Kijun-sen.

- Sell Trade: When Tenkan-sen cross below the Kijun-sen.

Tenkan-Kijun Cross (Advance):

- Buy Trade: When Tenkan-sen cross above the Kijun-sen + Tenkan-sen is above the Kumo Cloud + Kumo Cloud is bullish.

- Sell Trade: When Tenkan-sen cross below the Kijun-sen + Tenkan-sen is below the Kumo Cloud + Kumo Cloud is bearish.

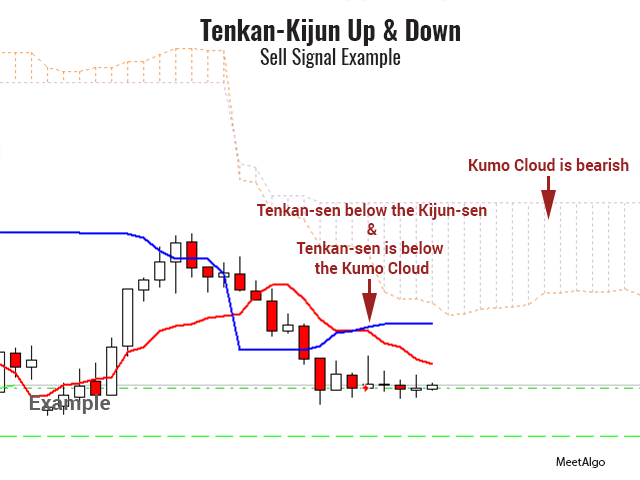

Tenkan-Kijun Up & Down:

- Buy Trade: When Tenkan-sen above the Kijun-sen + Tenkan-sen is above the Kumo Cloud + Kumo Cloud is bullish.

- Sell Trade: When Tenkan-sen below the Kijun-sen + Tenkan-sen is below the Kumo Cloud + Kumo Cloud is bearish.

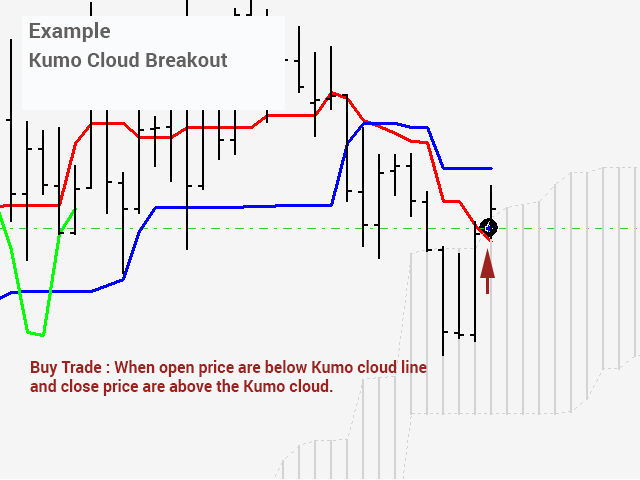

Kumo Cloud Breakout :

- Buy Trade: When open price are below Kumo cloud line and close price are above the Kumo cloud.

- Sell Trade: When open price are above Kumo cloud line and close price are below the Kumo cloud.

Kumo Cloud Breakout (Advance):

- Buy Trade: When open price are below Kumo cloud line and close price are above the Kumo cloud + Tenkan-sen is above Kijun-sen + Future Kumo is bullish.

- Sell Trade: When open price are above Kumo cloud line and close price are below the Kumo cloud + Tenlan-sen is below Kijun-sen + Future Kumo is bearish.

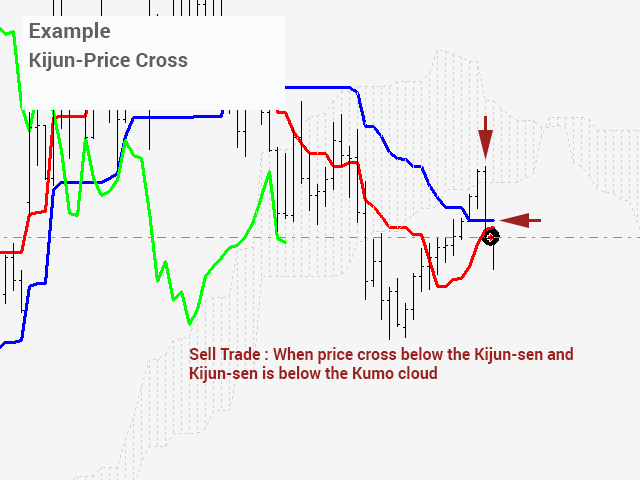

Kijun-Price Cross:

- Buy Trade: When price cross above the Kijun-sen and Kijun-sen is above the Kumo cloud.

- Sell Trade: When price cross below the Kijun-sen and Kijun-sen is below the Kumo cloud

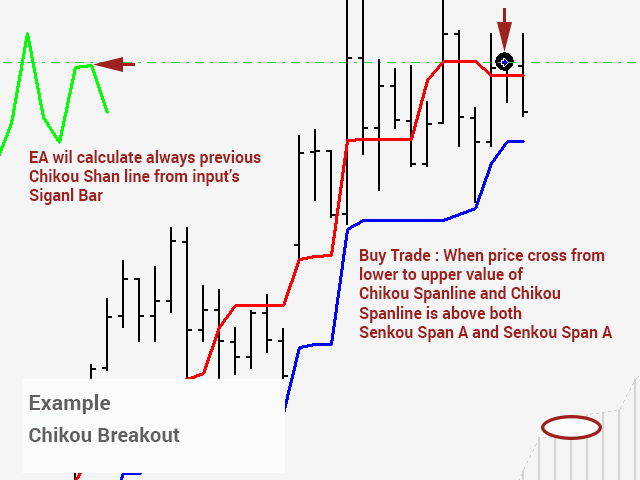

Chikou Breakout

- Buy Trade: When price cross from lower to upper value of Chikou Spanline and Chikou Spanline is above both Senkou Span A and Senkou Span A. When both condition meet it open buy trade.

- Sell Trade: When price cross from upper to lower value of Chikou Span line and Chikou Span line is below both Senkou Span A and Senkou Span A. When both condition meet it open buy trade.

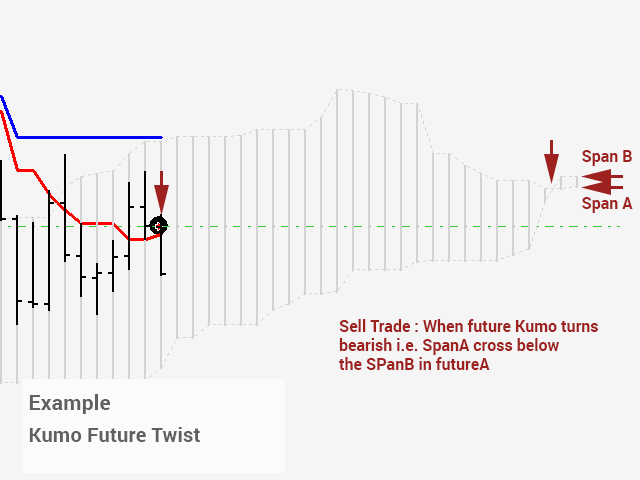

Kumo Future Twist

- Buy Trade: When future Kumo turns bullish i.e. SpanA cross above the SpanB in future.

- Sell Trade: When future Kumo turns bearish i.e. SpanA cross below the SPanB in future.

Ichimoku Strategy (For Exit) – Select your Exit Strategy.

Tenkan-Kijun Cross (Exit) :

- Buy Exit: When Tenkan-sen cross below the Kijun-sen.

- Sell Exit: When Tenkan-sen cross above the Kijun-sen.

Kumo Cloud Breakout (Exit) :

- Buy Exit: When price close below the Kumo cloud.

- Sell Exit: When price close above the Kumo cloud.

Kijun-Price Cross (Exit) :

- Buy Exit: When price close below the Kijun-sen.

- Sell Exit: When price close above the Kijun-sen.

Chikou Breakout (Exit) :

- Buy Exit: When price cross from upper to lower value of Chikou Span line and Chikou Span line is below cloud line.

- Sell Exit: When price cross from lower to upper value of Chikou Span line and Chikou Span line is above cloud line.

Kumo Future Twist :

- Buy Exit: When future Kumo turns bearish i.e. SpanA cross below the SPanB in future.

- Sell Exit: When future Kumo turns bullish i.e. SpanA cross above the SpanB in future.

Ichimoku TimeFrame – Select indicator time frame.

Tenkan-sen – Value of Tenkan-sen

Kijun-sen – Value of Kijun-sen

Senkou Span B – Value of Senkou Span B

Signal Bars [Ichimoku] (0-Current Bar) – Signal bar. Which bar are consider as signal bar. 0 mean current bar, 1 – mean previous bar of current bar.

Reverse Signal (Ichimoku) – If you set True, EA will reverse all it’s default signa. I mean when Buy signal found then EA will open sell trade.