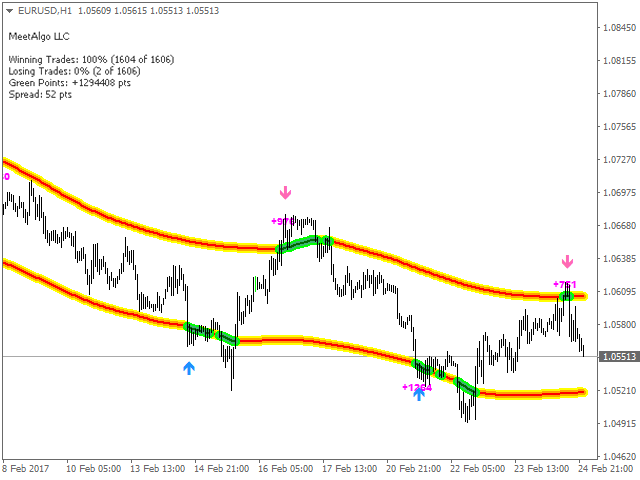

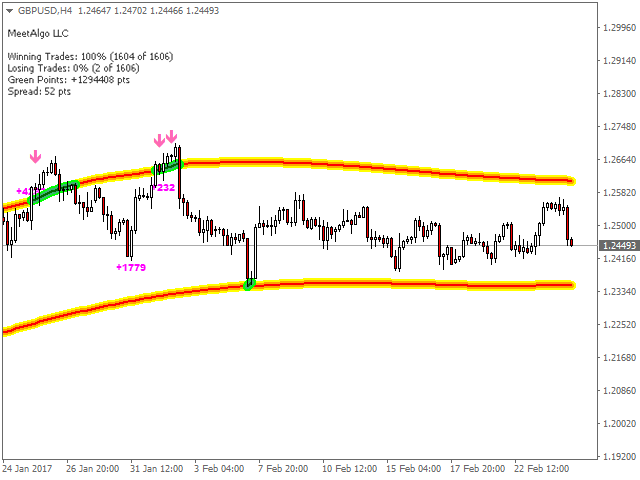

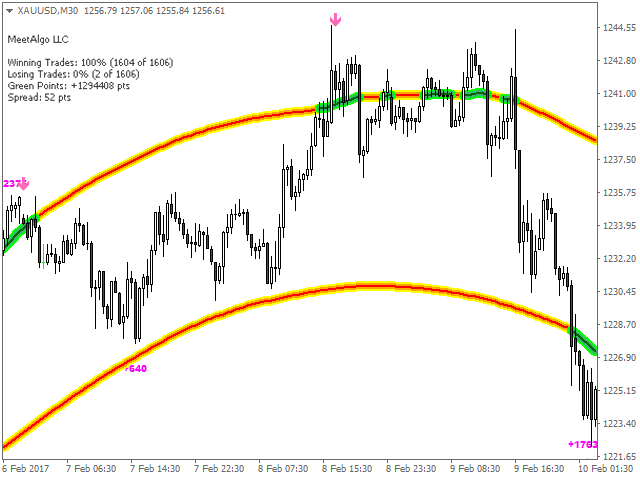

MeetAlgo Channel Trading is a volatility-based indicator that makes use of the “advanced envelope theory”. These envelopes consist of two outer lines. Envelope theory states that the market price will generally fall between the boundaries of the envelope (or channel). If prices move outside the envelope, it is a trading signal or trading opportunity.

Channels can make a for a good trading strategy because they can not only show what “normal price movement” should be but also when a price event happens outside the normal behavior of price.

Channels Measure Price Extremes

It is the buying and selling by humans (and computers although the trading programs are programmed by humans) that will move price. As humans, we are susceptible to emotions and beliefs and emotions are even more vulnerable when money is on the line. Channels, are theoretically designed to surround the general price action of the charted instrument. The key words are “general price action” because anything seen outside of the general movement of price can be considered an extreme movement.

The key words are “general price action” because anything seen outside of the general movement of price can be considered an extreme movement.

One way to envision this general movement is consider that the price is travelling without an extreme bullish or bearish bias. While there may be an overall bias in one direction, there is nothing out of the ordinary with the movement of price. There are times when a “that’s different” moment takes place and the price will make a move in one direction or the other. This is the time when you want to be on alert for potential trading opportunities as it is clear that volatility has increased. You use the word potential because you don’t want to take a trade based on one indicator alone.

How to trade

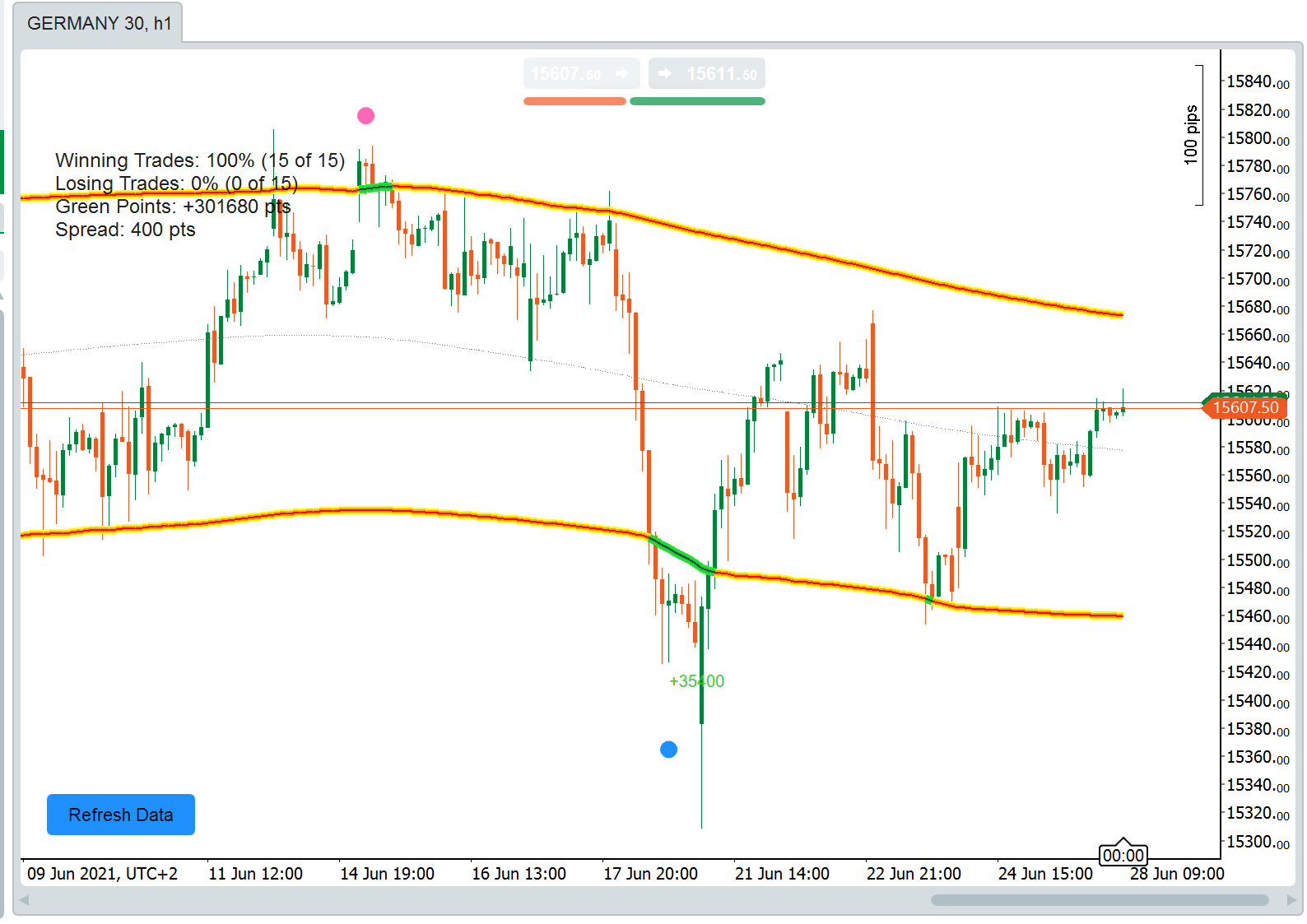

Basically MeetAlgo Channel Trading can be used to help identify overbought and oversold conditions in a market. When a market’s price is close to the upper band, the market is considered overbought (buying area). Conversely, when a market’s price is close to the bottom band, the market is considered oversold (selling area). Indicator give you arrow signal when price try to reversal. It is recommended to open positions when the price comes 30 points or closer to the channel border.However, this study can be used to help determine the strength of a price trend. Some traders use a market price move and price close that is above the upper band of the Channel Trading as a buy signal, and use a push below and price close below the lower band as a sell signal.

An advantage of Channel Trading indicator compared to other channel indicators is that market lag is not as pronounced because CAP Channel Trading are extremely sensitive to fluctuations in volatility.

By varying the bands on the most recent average daily price range, the channels will naturally be a greater distance from the market when the price swings are wide than when they are narrow. However, they will stay at a much more constant width than other envelope methods.

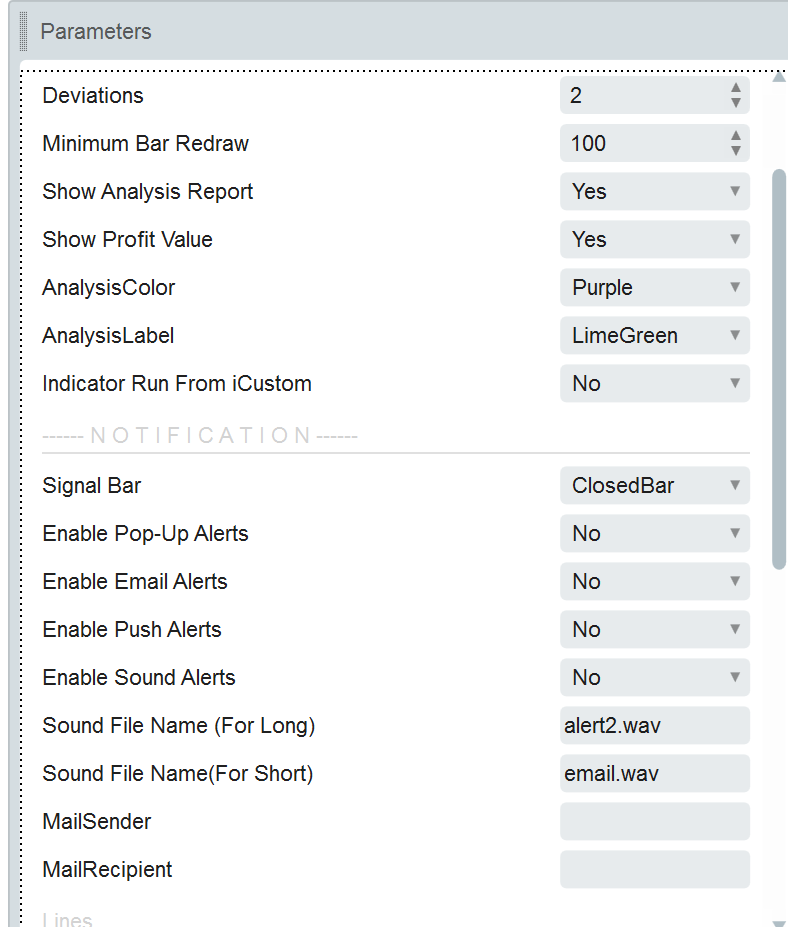

Input Parameters

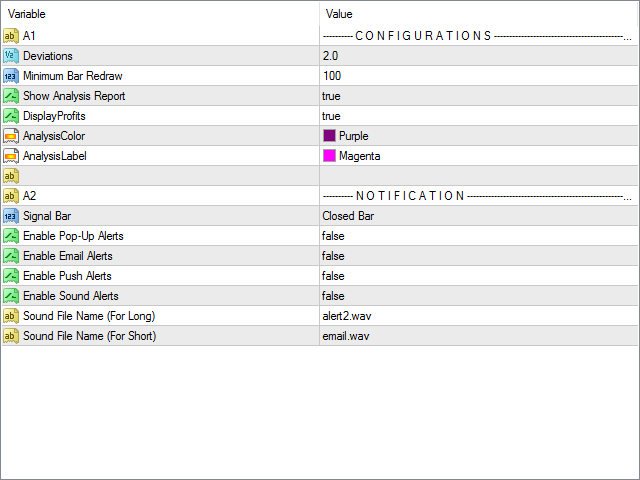

- Configurations

- Deviations- Band deviations.

- Minimum Bar Redraw - Minimum to re-calculate to draw the channel.

- Show Analysis Report - Show analysis repost on chart.

- DisplayProfits - Display profit of every signal on chart.

- Notification

- Signal Bar- work on the current bar / work on closed bars.

- Enable Pop-Up Alerts: You will get an alert message in your MetaTrader platform.

- Enable Email Alerts: You will get an e-mail if you set up the correct e-mail settings for your e-mail provider at your MetaTrader platform.

- Enable Push Alerts: You will get a notification on your mobile device if you set up the mobile notification settings of your MetaTrader platform.

- Enable Sound Alerts: You will get an audio notification in your MetaTrader platform.

- Sound File Name (For Long): Enter the name of a sound file to hear an individual audio notification. The selected sound file must be installed in the “Sounds” directory of your MetaTrader 4 platform.

- Sound File Name (For Short): Enter the name of a sound file to hear an individual audio notification. The selected sound file must be installed in the “Sounds” directory of your MetaTrader 4 platform.

Info

Info