Trading Strategies

Seven popular trading strategies based on the various Breakout Each of the strategies has it unique entry and exit point without any interference to other strategies.

Input Parameter

Initial Strategy Setting

Breakout Strategy – Select your Entry Strategy.

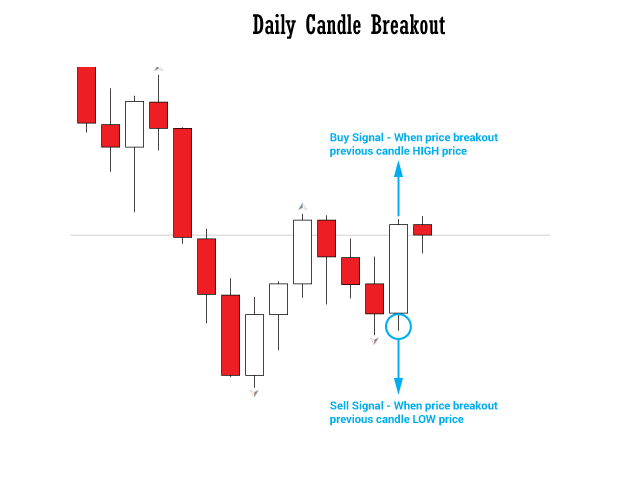

Daily Candle Breakout:

This strategy uses the previous day’s High and Low as breakout levels.

Buy Trade

- A Buy trade is opened when price breaks above the previous daily High.

Sell Trade

- A Sell trade is opened when price breaks below the previous daily Low.

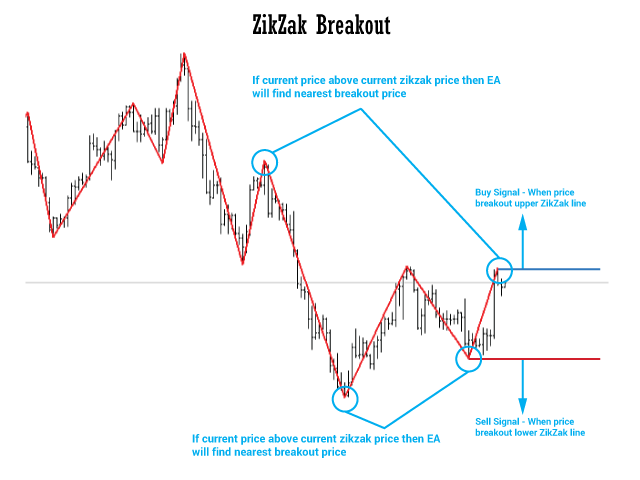

Zik Zak Breakout:

This strategy uses ZigZag swing points as breakout levels.

Buy Trade

A Buy trade is opened when price breaks above the nearest upper ZigZag level.

Sell Trade

A Sell trade is opened when price breaks below the nearest lower ZigZag level.

Important Note

If the current price is already above or below the latest ZigZag level,

the EA automatically finds the nearest valid upper or lower ZigZag level for the breakout.

ZigZag Parameters (Used only for ZigZag Breakout)

InDepth (ZigZag BK) – Controls how many bars ZigZag analyzes to detect swings.

InDeviation (ZigZag BK) – Defines minimum price deviation required to form a ZigZag point.

InBackstep (ZigZag BK) – Controls how close ZigZag points can appear.

✔ Best suited for: Swing breakouts and structure-based trading

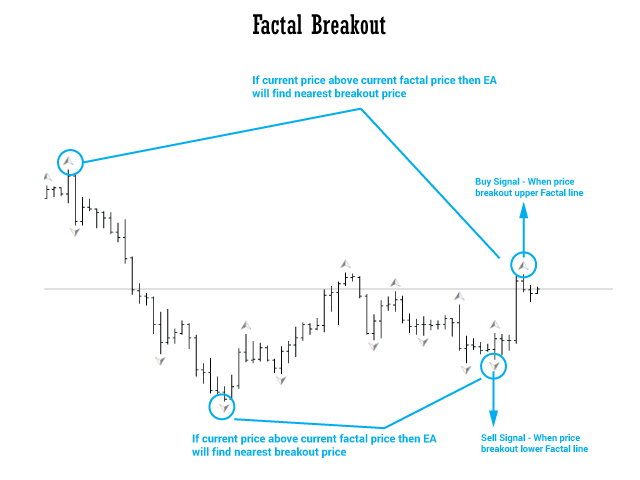

Factal Breakout :

This strategy uses Fractal indicator levels.

Buy Trade

A Buy trade is opened when price breaks above the nearest upper Fractal.

Sell Trade

A Sell trade is opened when price breaks below the nearest lower Fractal.

Important Note

If price has already crossed a Fractal level,

the EA automatically searches for the next nearest valid Fractal.

✔ Best suited for: Market structure and reversal-to-breakout setups

Note – If the current price is already above or below the current factal price then EA will look for the nearest upper or lower factal price for the breakout signal

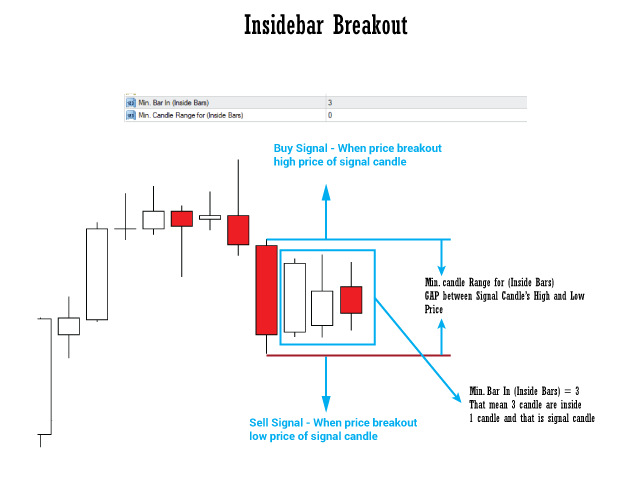

Insider Bar Candle Breakout :

An Inside Bar forms when one or more candles are completely inside a previous “master” candle.

That master candle becomes the signal candle.

Buy Trade

A Buy trade is opened when price breaks above the High of the signal candle.

Sell Trade

A Sell trade is opened when price breaks below the Low of the signal candle.

Inside Bar Parameters

Min. Bar In (Inside Bars)

Number of inside candles required to validate a signal candle.Min. Candle Range (Inside Bars)

Minimum High–Low range (in points) of the signal candle.0 = disabled

✔ Best suited for: Low-volatility compression and explosive breakouts

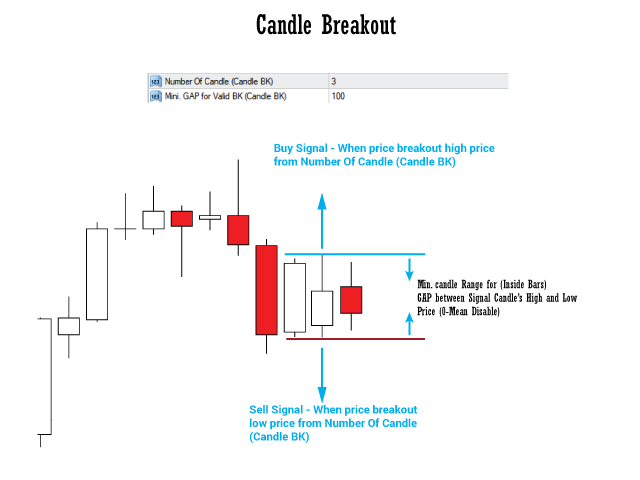

Candle Breakout:

This strategy finds the highest High and lowest Low from a fixed number of previous candles.

Buy Trade

A Buy trade is opened when price breaks above the highest High.

Sell Trade

A Sell trade is opened when price breaks below the lowest Low.

Candle Breakout Parameters

Number Of Candle (Candle BK)

Number of candles used to detect breakout levels.Min. GAP for Valid BK (Candle BK)

Minimum High–Low range (in points) required for a valid breakout.0 = disabled

✔ Best suited for: Range breakouts and momentum entries

Pivot Breakout:

This strategy uses calculated Pivot Levels based on previous price data.

Buy Trade

A Buy trade is opened when price breaks above the selected Pivot resistance level.

Sell Trade

A Sell trade is opened when price breaks below the selected Pivot support level.

Pivot Parameters

Pivot Level

H4 / L4

H3 / L3

H2 / L2

✔ Best suited for: Institutional-style support and resistance breakouts

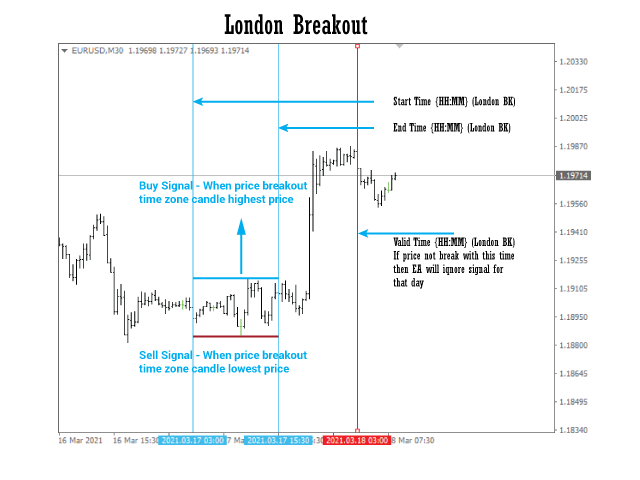

London Breakout:

This strategy trades breakouts from the London session range.

How it works

EA calculates the High and Low between Start Time and End Time

That range becomes the breakout box

Buy Trade

A Buy trade is opened when price breaks above the box High

Sell Trade

A Sell trade is opened when price breaks below the box Low

London Breakout Parameters

Start Time (London BK) – Range calculation start time

End Time (London BK) – Range calculation end time

Valid Time (London BK) – If price does not break out before this time, EA skips trading for the day

Min. GAP High/Low (London BK) – Minimum box range (points),

0 = disabled

✔ Best suited for: Session volatility and institutional volume moves

Parabolic SAR Breakout

This strategy uses Parabolic SAR values as dynamic breakout levels.

Buy Trade

A Buy trade is opened when price breaks above the Parabolic SAR value

Sell Trade

A Sell trade is opened when price breaks below the Parabolic SAR value

Parabolic Parameters

Step – Sensitivity of SAR

Maximum – Maximum acceleration factor

✔ Best suited for: Trend-following breakout entries

Others Input Parameter-

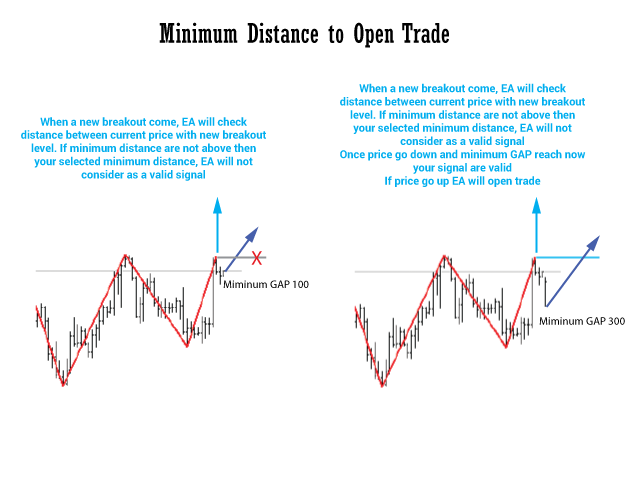

Minimum Distance To Open Trade

Minimum distance (in points) price must move beyond the breakout level to confirm a valid breakout.

Helps filter false breakouts.

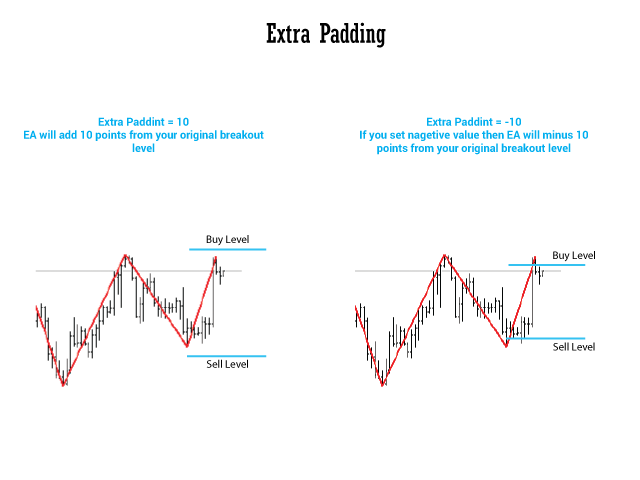

Extra Padding

Adds or subtracts points from the original breakout level.

Example

Breakout level:

1.2000Extra Padding =

10Buy level becomes:

1.2010

Negative Padding Example

Extra Padding =

-10Buy level becomes:

1.1990

0 = No padding

Reverse Signal (Breakout)

If enabled, EA reverses all signals

Buy signal → Sell trade

Sell signal → Buy trade

Useful for mean-reversion or counter-trend strategies.