MeetAlgo Strategy Builder EA was developed by MeetAlgo.com and in its heart, putting in blood and sweat, is the lead our developer with over 10 years of experience in trading knowledge and the development of Expert Advisors.

With constant trials and errors, building on learning curves of experience, a solid understanding of what traders need, MeetAlgo Strategy Builder EA was born. A tool developed with 10 years of experience that was consolidated into that EA, all in the effort to make your trading journey a safer, effortless and pleasant one.

What is MeetAlgo Strategy Builder EA?

Ever heard the saying that the whole is greater than the sum of its part. Well, Aristotle got it wrong when it comes to MeetAlgo Strategy Builder EA cause the sum of its parts is greater than the whole and this cannot be any truer when it comes to this little handy tool, because it is not only a strategy builder. It is much greater than that. It allows you to

- Build Strategies using its many in-built inputs.

- Develop current strategies you may be using.

- Manage your trades in one panel.

- Keep track of your trades.

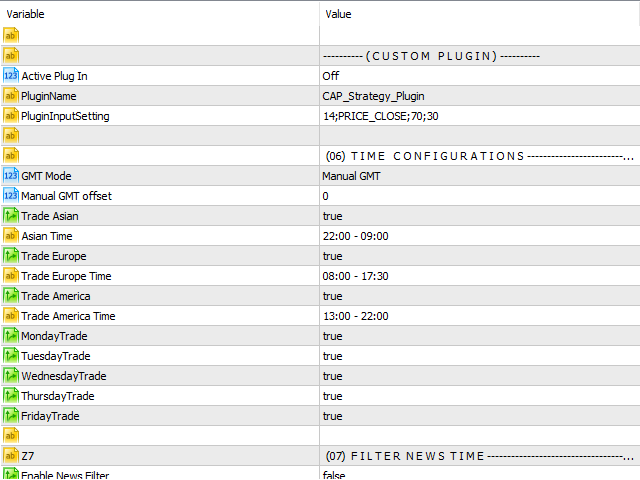

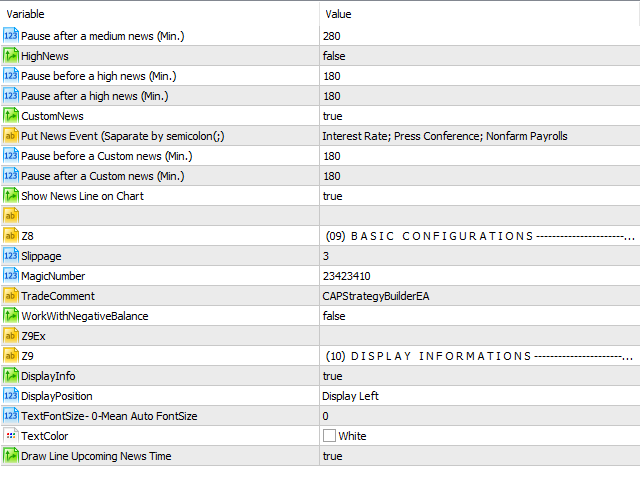

- Avoid trades during volatile times.

- Create exit and entry strategies.

- Manage the risk of trades.

- Scan all markets to find currency pairs, stocks or commodities that meet your criteria.

- Let the EA automatically place trades that meet your criteria and manage them for you.

It is all that and more, it was designed for both beginners and professionals. MeetAlgo Strategy Builder EA EA can be simply placed on any single chart and you can allow it to trade for you. Or you can control every aspect of the trade to the dot as they say.

If I dare to try to summarize MeetAlgo Strategy Builder EA in one line, I would say.

“A tool that was developed to create and build on strategies, execute and automate the management of trades whilst providing a user-friendly panel to track all orders.” But I can’t stop there, no sir, I can’t stop there because I won’t be giving it justice without adding “And much more….”.A Closer look into the capabilities of MeetAlgo Strategy Builder EA

Well, I guess I heard enough, I want to know what can I do with MeetAlgo Strategy Builder EA and how can it benefit me as a trader. In order to see the abundance of possibilities let us put in place some scenarios and see how MeetAlgo Strategy Builder EA can benefit us.

Scenario 1: I want to develop a strategy or improve on my existing strategy.

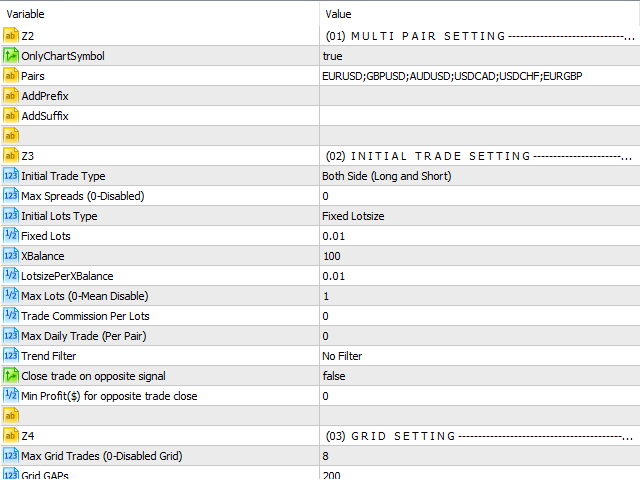

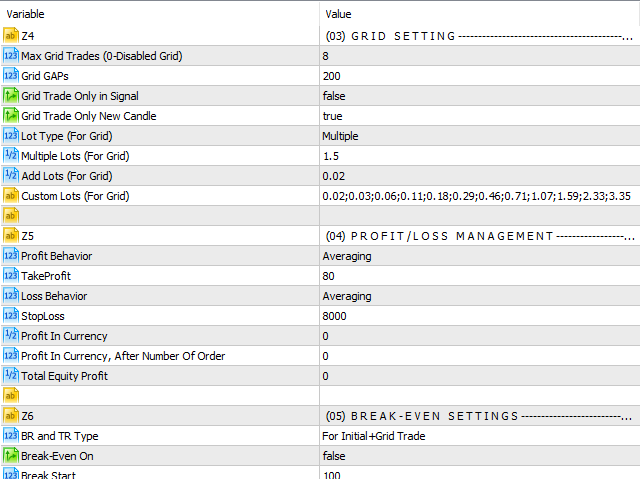

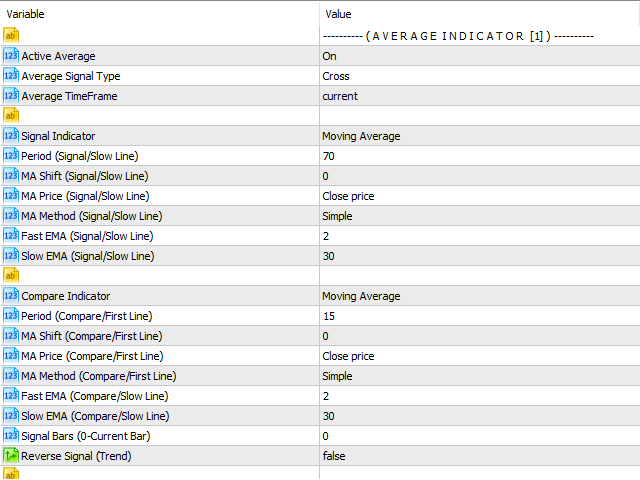

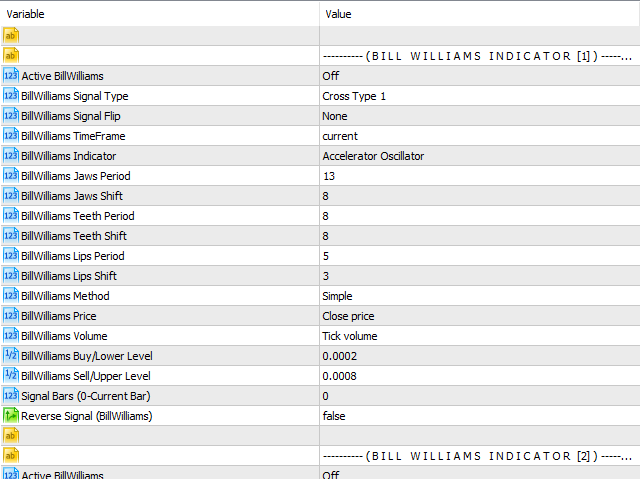

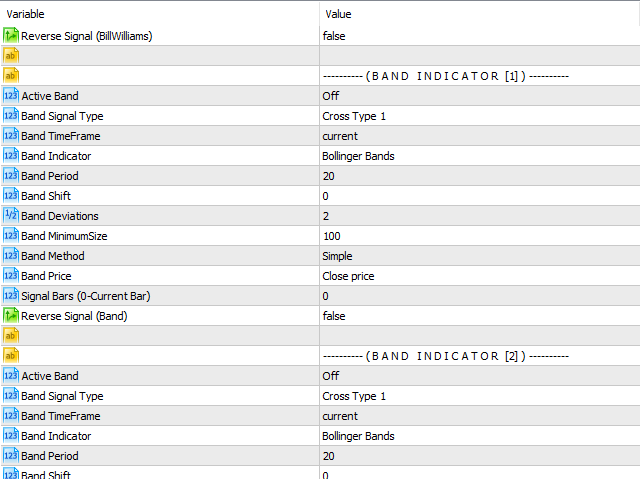

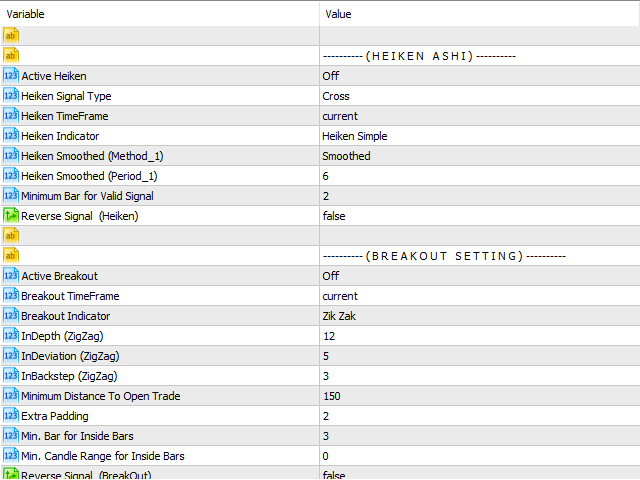

We all know that clear entry and exit strategies are needed when trading. It could be based on RSI, Moving Averages, Market Structure, Trends. Well, MeetAlgo Strategy Builder EA has over 34 built in indicators which you can combine into your strategy or build a plethora of strategies.

You can then backtest these strategies, optimize them and save yourself a lot of time to deploy a new, dare I say it better strategy effortlessly and seamlessly.

Scenario 2: I want to manage the exit of my trades

In the end of the day, we are not robots, we can’t stay awake all the time to monitor our trades. That’s the reason why sometimes we use hard Stop-Losses and Take-Profits.

But what if we can manage that order, we can tell it when it should exit, maximize the potential of that order by using trailing stops, or even open new trades in the opposite direction if the trade goes against us.

All that can be achieved by this handy tool, fully automated without you having to be present and knowing exactly how your trade will conclude.

Scenario 3: I want to scan the markets to see which pairs, stocks or commodities meet my criteria.

Well, we have a working strategy and now I want to know which pairs, stocks or commodities meet my criteria so I can execute the trade. With 100s’ if not 1000s’ of stocks, commodities, and pairs to monitor, one may say it’s almost impossible to keep your eye on each and every single one of them.

This little handy tool will do just that for you. Don’t miss an opportunity that sets up with your trading strategy. This tool will scan the market(s) and once a criteria meets your strategy it can automate the execution of the trade for you. That by itself is a godsend blessing.

Scenario 4: I want to keep track of all my orders in one location.

We’ve all been there, how many orders do I have open? Are they in a profit or loss? What are my positions?

With MeetAlgo Strategy Builder EA it’s simple to monitor all the important aspects of your account in one easy-to-use Graphical User Interface. With just one glance you get the executive summary of your overall account performance and positions.

Scenario 5: I want to manage my risk exposure

Yes, as the old saying goes, “You can be a successful trader with zero knowledge in trading but having good risk management.” Cap Strategy EA can automate this portion for you. Enter trades with this tool which calculates trades based on your account balance taking into consideration how much risk you are willing to take per trade.

The usefulness of this becomes apparent when you need to enter multiple trades at different time intervals. Has the first trade closed? How much drawdown am I in to calculate my new position. Let this handy tool do the work for you.