MeetAlgo Zone Recovery EA is your tool to turn losing trades into winning trades by using a smart “back-and-forth” hedging mechanism. I call it the “Never Lose Again Strategy”. Let the price move to anywhere it likes – the awesome MeetAlgo Zone Recovery EA will make profits out of the situation. Guaranteed! The secret behind this amazing EA is a famous trading algorithm known as “Zone recovery algorithm” or “The Surefire Forex Hedging Strategy”.

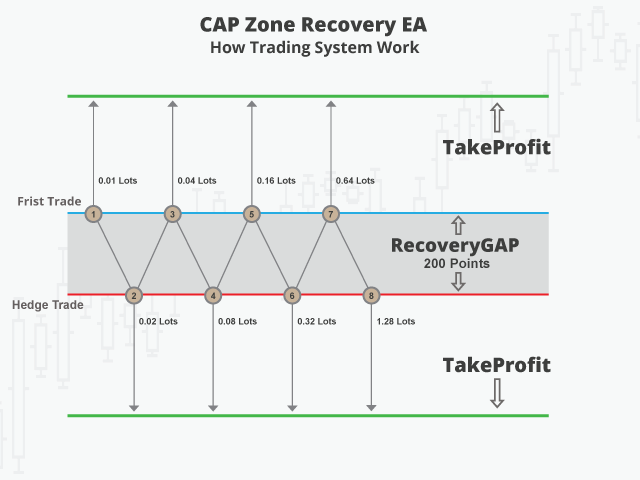

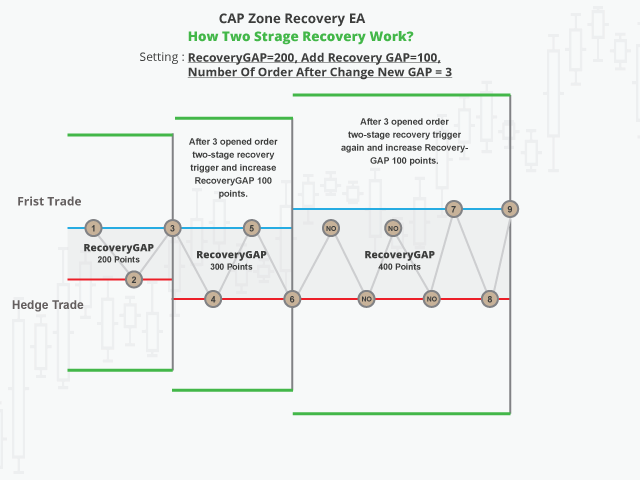

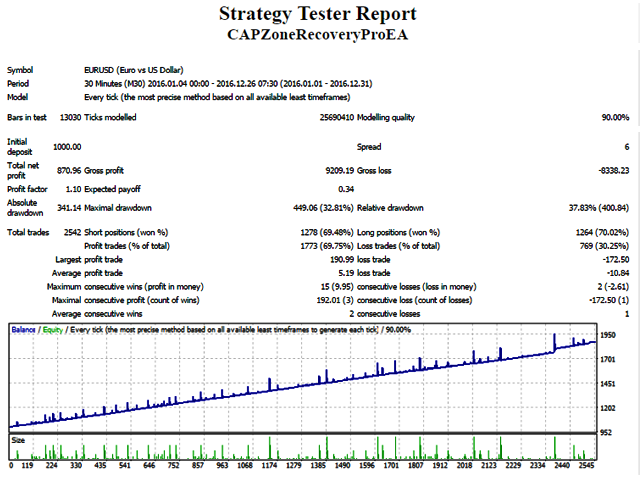

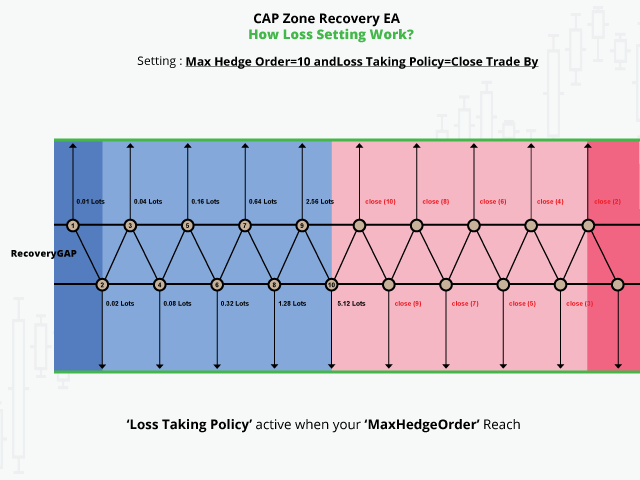

MeetAlgo Zone Recovery EA is extremely easy to use. You just open a trade in a trending market – no matter which direction. You just enter a Take Profit level, no Stop Loss! Again: You will never again lose money because your trade hits the Stop Loss! Instead, this EA uses a smart hedging technology turning even losses into wins. In case the market moves in the unfavorable direction, the Zone Recovery Algorithm starts hedging your trade by placing an opposite order, but with multiple lot size. If market should turn again, the same procedure starts again. The result is a “trading channel” with an upper TP and a lower TP and an alternating series of buy and sell trades at specific levels and with different lot sizes within this channel. Once one of the TP levels is hit – and we all know it is absolutely sure that either the higher TP or the lower TP is reached – all open trades will close with a combined profit.

Let’s say you just entered the market with a “buy market” position with 0.01 lots and your RecoveryGAP=200 points and TakeProfit=300 points. CAP Zone Recovery EA places a pending “stop sell” order to hedge your position instead of a Stop Loss in a predefined distance. What can we predict for sure? The market will move – either up or down. It can take some time, but it will move because it simply has to!

At this point, two scenarios are possible:

- Scenario 1: Market moves up (without reaching your Recovery activation level in the meantime) and hits your Take Profit. The trade is closed and your profit is fixed.

- Scenario 2: Market moves down and reaches Recovery activation level. A trade to the opposite direction is opened with different lot size. Again, for this order a pending order is placed hedging the new position. A new Take Profit is determined for all trades. This procedure is repeated with any change in market direction unless the Take Profit is hit and all trades are closed with combined profit.

Key Features

- Easy to set up and supervise.

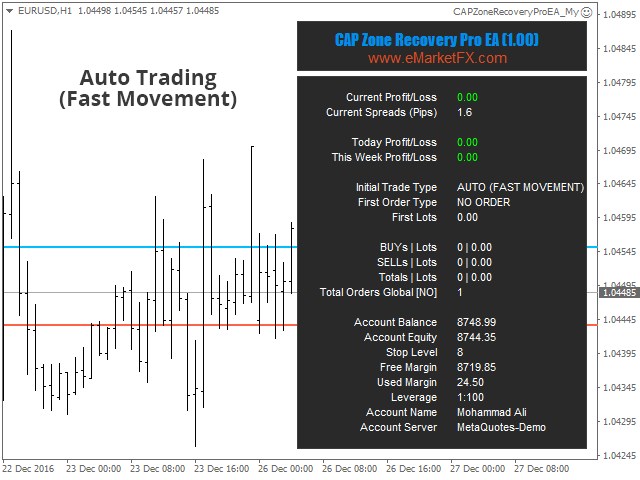

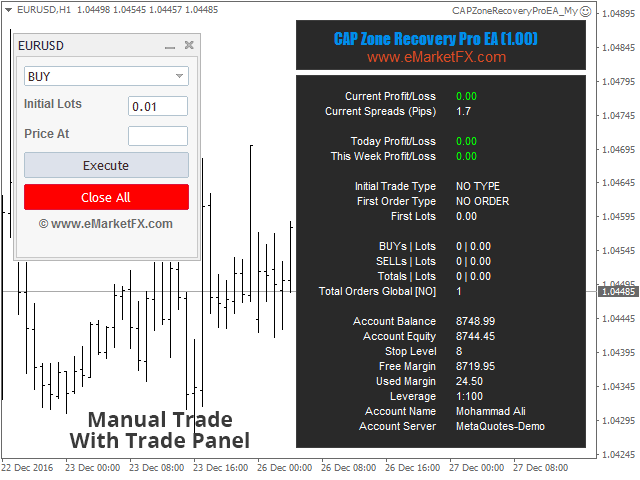

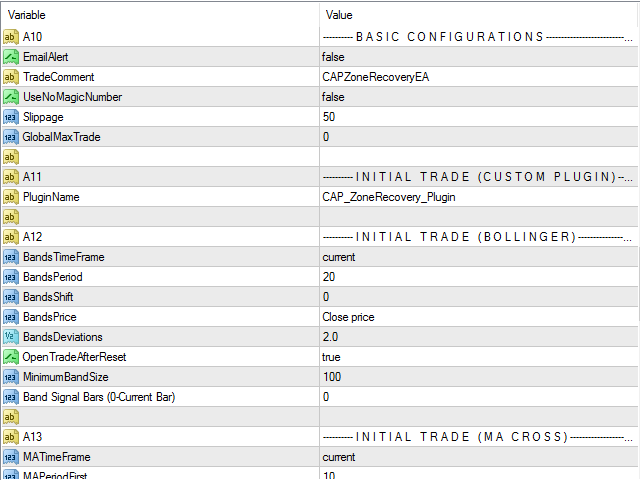

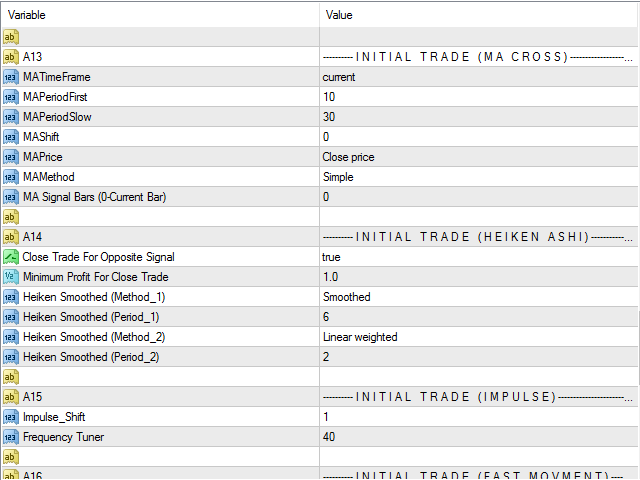

- Build in Automatic trading strategy. EA can manage your manual but also you can set full automatic. EA come with more then 16+ automatic trading strategy to open your initial trade.

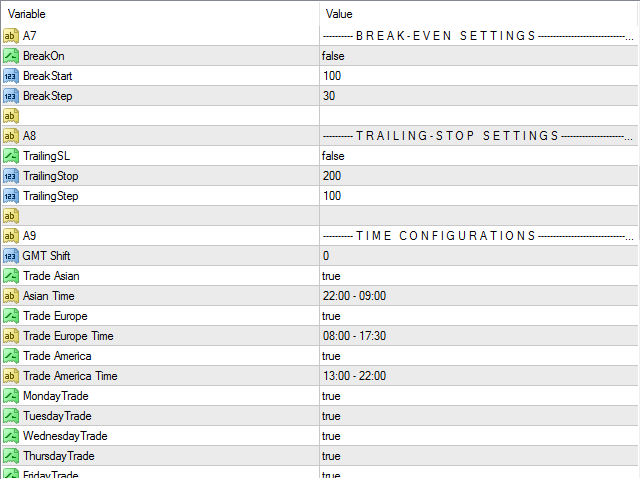

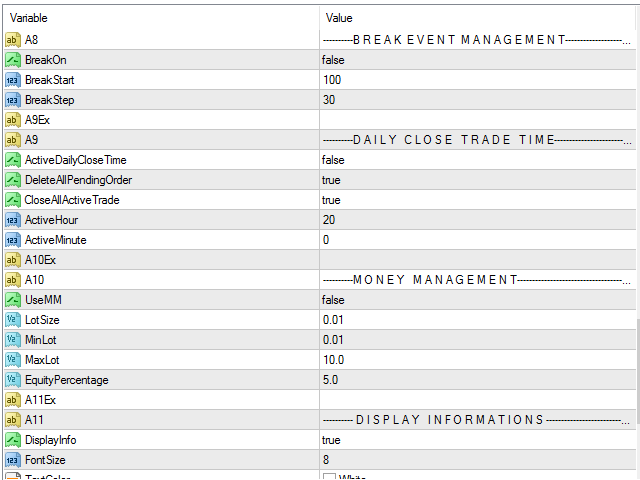

- Break Event and Trailing. Break event or Trailing can be work both initial trade and hedge trade.

- Can be work on CDF, INDEX or Brazilian stock market

- Customization capabilities for future. A unique customization code will be assigned that will perform the relevant customization functions once the code is entered. Options will be controlled by an external file.

Advantages:

- No more losses, only wins!

- Initial trade with TP, Trailing Stop and Break Even functionality

- Hedging mechanism instead of Stop Loss

- Multiple lot sizing (more intelligent than simple martingale system)

- Intelligent lot sizing

How To Trade

No complicated rules, EA Just follow 5 simple steps!

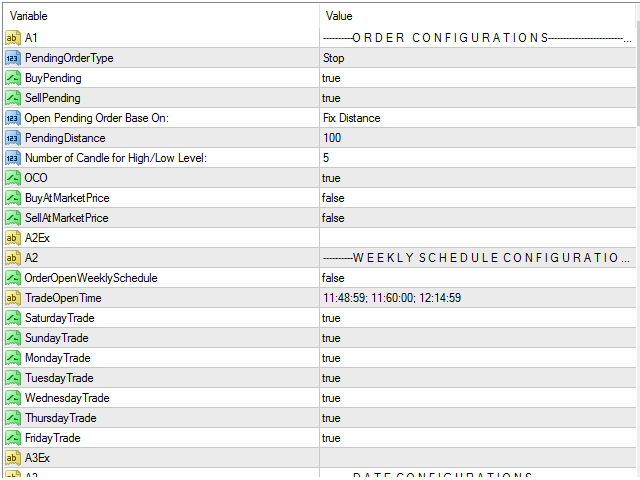

- Step 1: Setup Initial Trade Type – Setup your initial trade type. how your first trade will be open.

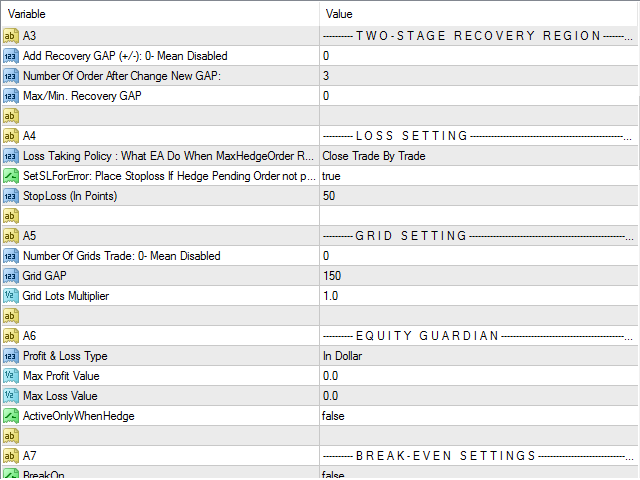

- Step 2: Active/Disable Grid Setup – If your enable grid then your initial trade in Loss then EA try to make profit by grid trading. But still your trade in loss then EA active “Zone Recovery Strategy”, It is optional.

- Step 3: Configure your Recovery Trade Setting – If your initial trade + grid trade are not make profit, then EA active “Zone Recovery Strategy” turn your losing trade into profit

- Step 4: Non-Hedge Mode

- Step 5: Configure Loss Taking Policy – If your initial trade + grid trade are not make profit, and also your “Zone Recovery Strategy” fail to make profit, then EA active Loss Trading Policy

Pay attention to:

- Select broker with best commissions and slippage

- Avoid ranging markets! Look for trending markets!

- Avoid off-hours or lower volatility sessions

- Choose initial lot sizing carefully! Avoid running out of free margin after some market turns!